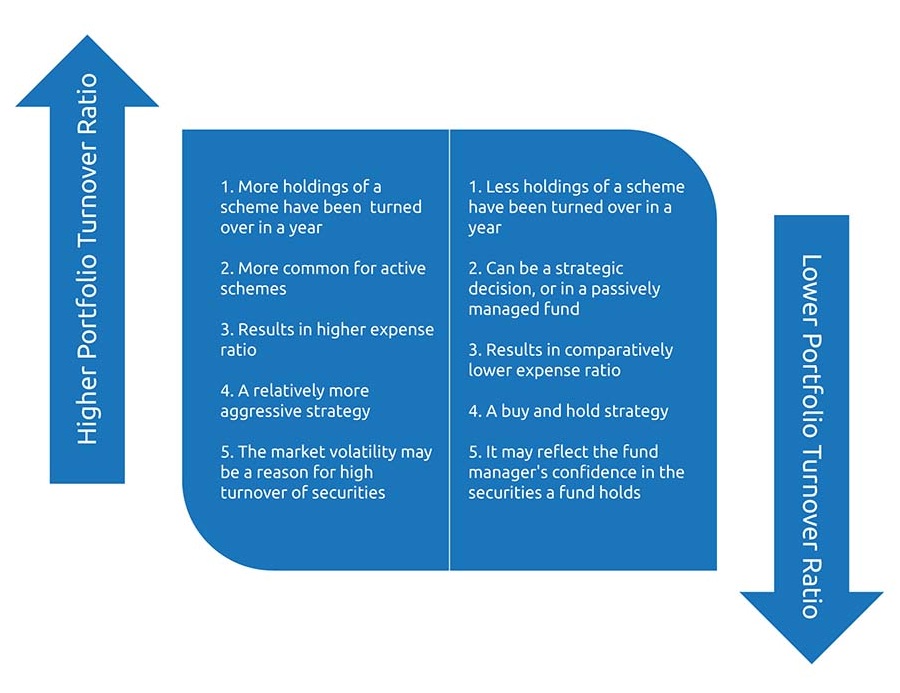

With regards to the income funds, the brokerage costs are lower than the equity funds, the effect of this turnover is not as severe as its effect on the equity funds. Moreover this ratio is not applicable to new funds as the fund has yet to deploy its funds fully. On the other hand, index funds are not much affected by the turnover ratio as the fund manage buys and sells only if there is change in the index composition, redemptions and any new investments in the fund. This can dramatically affect the fund’s returns. The danger here is that when choosing the company to buy or sell, he fund manager can take a wrong call. Funds like flexicap funds, where the fund manager has the mandate to switch between the companies of different market capitalizations, have higher turnover ratio. As these costs go up, the fund’s returns are affected significantly. In the funds, where equities are involved, these trading costs can be quite significant. But if the returns cannot justify the high ratio, then such a fund has to be avoided. IMPORTANCE OF TURNOVER RATIO FOR EQUITY FUNDSĭo you think high turnover ratio is bad? It may not be so if the fund can manage to give high returns. So while investing, it is important for you to keep a watch on this ratio. In turn, these expenses are passed on to the mutual fund and ultimately to the investors. This is important as each time the fund buys and sells the stocks, he incurs brokerage expenses. In order to answer these questions, you need to understand turnover ratio. The question that arises: why does the fund manager do so and how does it impact the fund’s returns? In certain cases, the fund manager tends to buy stocks and hold onto them for a long time and only sells them if certain situations so demand.īut in other cases, the fund manager keeps on buying and selling the stocks that his fund holds. When you are investing in a mutual fund, it is important for you to remember that the fund manager follows his own style of handling your portfolio. So always watch out for the turnover ratio when choosing the fund. While this strategy can give you high returns, it is more likely that the fund manager may make wrong choice.

A broker looks at a computer screen while trading at a stock brokerage firm in Mumbai November 11, 2008.

0 kommentar(er)

0 kommentar(er)